With Paysend, your Canadian friend would get C$641.43 in his or her bank account - that’s over 5% more than they would have received with Chase Bank. With Paysend, you’d pay no transfer fees and only $3.27 USD in exchange rate margin fees.

Chase Versus a Money Transfer SpecialistĬontrast this with Paysend, a money transfer specialist that was the found as the cheapest service for this transfer of Monito’s comparison engine at the time of writing. After paying the $27.75 in total fees (derived from the $5 transfer fee and a standard 5% exchange rate margin fee), your friend would receive C$608.81 at the time of writing. Suppose we send an average sized wire of $500 USD to a friend in Canada and have that transfer converted to Canadian dollars. When we take both the hidden USD to CAD exchange rate margin fee, and Chase Bank’s fixed fees into account, international wires quickly become very expensive. How Expensive Is Chase Bank for Wire Transfers? The exchange rate we use will include a spread and may include commissions or other costs that we, our affiliates, or our vendors may charge in providing foreign currency exchange to you. The foreign exchange rates we use are determined by us in our sole discretion. Looking at the fine print of their international wire transfer terms, we read the following: You can be confident that Chase Bank is no exception to these rates. If you are a customer, make sure to compare their rate with the mid-market rate (which you can find on Google or XE.com) before you complete your transaction.ĭespite this lack of transparency, we have found that the average American bank will charge an exchange rate margin of anywhere between 4% to 7%. Unfortunately, Chase Bank does not publicly disclose its exchange rate schedule to the public. Chase Bank International Wire Transfer Exchange Rates This is largely why Chase Bank is able to charge $0 to $5 fees on transfers denominated in foreign currency - they are able to profit by pocketing the margin between the real rate and their weaker rate. Instead, the bank will use an exchange rate that is weaker than the mid-market rate, and they will keep the difference for themselves.

#Chase bank incoming wire instructions full#

When converting your USD into foreign currency, Chase Bank will not apply the true mid-market rate to realize the full value of your dollars. In addition to the fixed fees detailed above, Chase Bank will also charge a hidden fee known as an exchange rate margin every time you send money abroad with them.

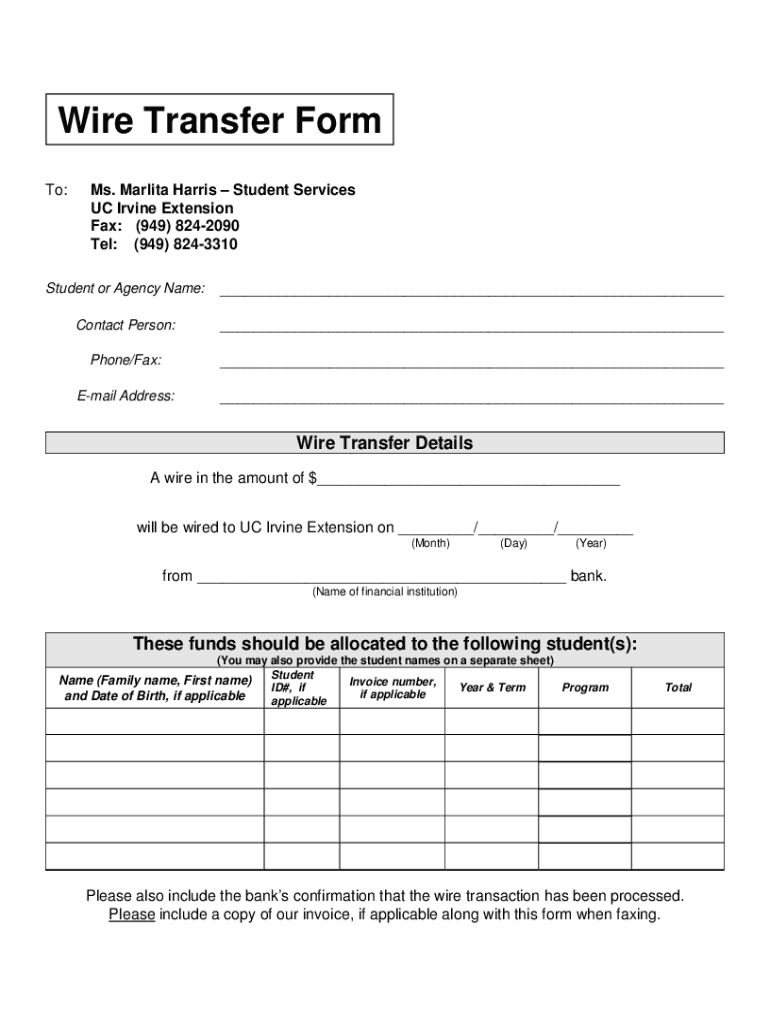

To send money abroad with Chase Bank, you will need to do so using a wire transfer. We encourage you to establish a back-up initiation method as soon as possible.What Are Chase Bank’s International Wire Transfer Fees?

If you do not have a back-up initiation method, such as another internet product or telephone initiation, and you need to initiate a funds transfer payment, please contact Client Service to communicate wire instructions on your behalf. If you do not have telephone initiation as your alternate funds transfer initiation method and you need to initiate a funds transfer payment, an authorized signer for your account may also initiate funds (wire) transfers at any Chase branch. Keep in mind there is a two week lead time for PIN re-issuance. If you need to be set up for funds transfer telephone initiation or if you've forgotten your Personal Identification Number (PIN), please contact your customer service representative. If you are unable to access the service you use for funds transfer initiation and are currently set up for telephonic funds transfer initiation as your back-up method, you can call the Voice Response Unit at 1-85 to initiate your transactions. JPMorgan Chase is prepared to support alternate initiation methods of funds (wire) transfer for clients who have established appropriate security setup in advance (agreement on file).

0 kommentar(er)

0 kommentar(er)